Overview

The Federal Board of Revenue’s (FBR) customs classification committee announced a 50% customs levy on the import of “Semi-Hybrid Cars”.

FBR stated that vehicles without electric motors could not be classified as hybrid vehicles to receive tax breaks.

FBR Classification Committee Issue Rules On Semi-Hybrid Cars

The FBR’s classification committee issued a decision rejecting an importer’s application.

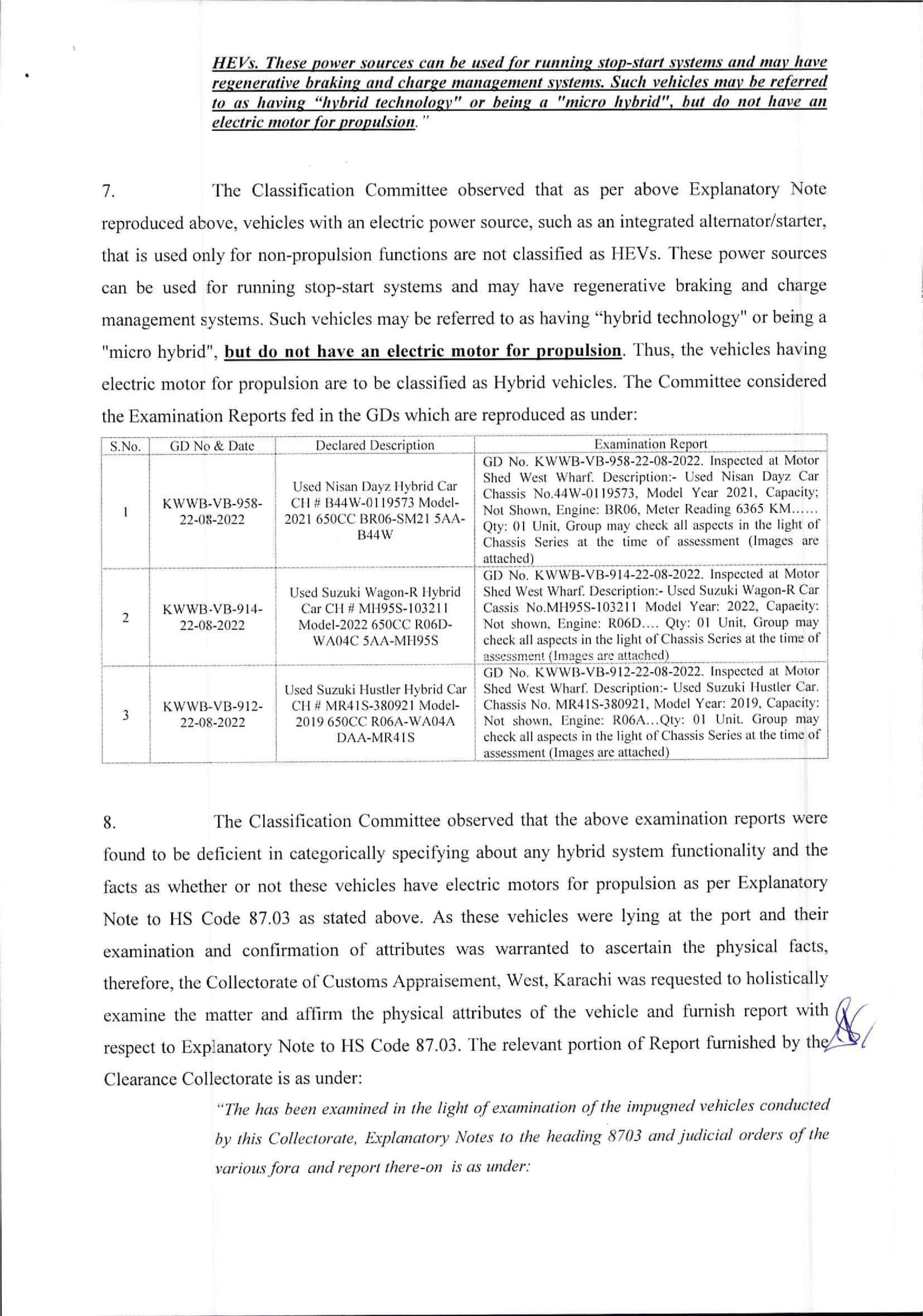

According to the Classification Committee Vehicles having an electric power source, such as an integrated alternator/starter, that is exclusively utilized for semi-functions are not categorized as HEVs. These power sources can power stop-start systems, as well as regenerative braking and charge control systems.

Such vehicles may be called “hybrid technology” or “semi-hybrids,” although they lack an electric motor for operation. Hybrid cars are those that use an electric motor for power.

According to the report and symbol, these cars build and fitted with Hybrid Technology features to achieve a number of desirables. Such as running stop-start systems and charge control systems, etc.

However, a physical assessment of operation and features revealed that these vehicles did not contain an electric motor for power.

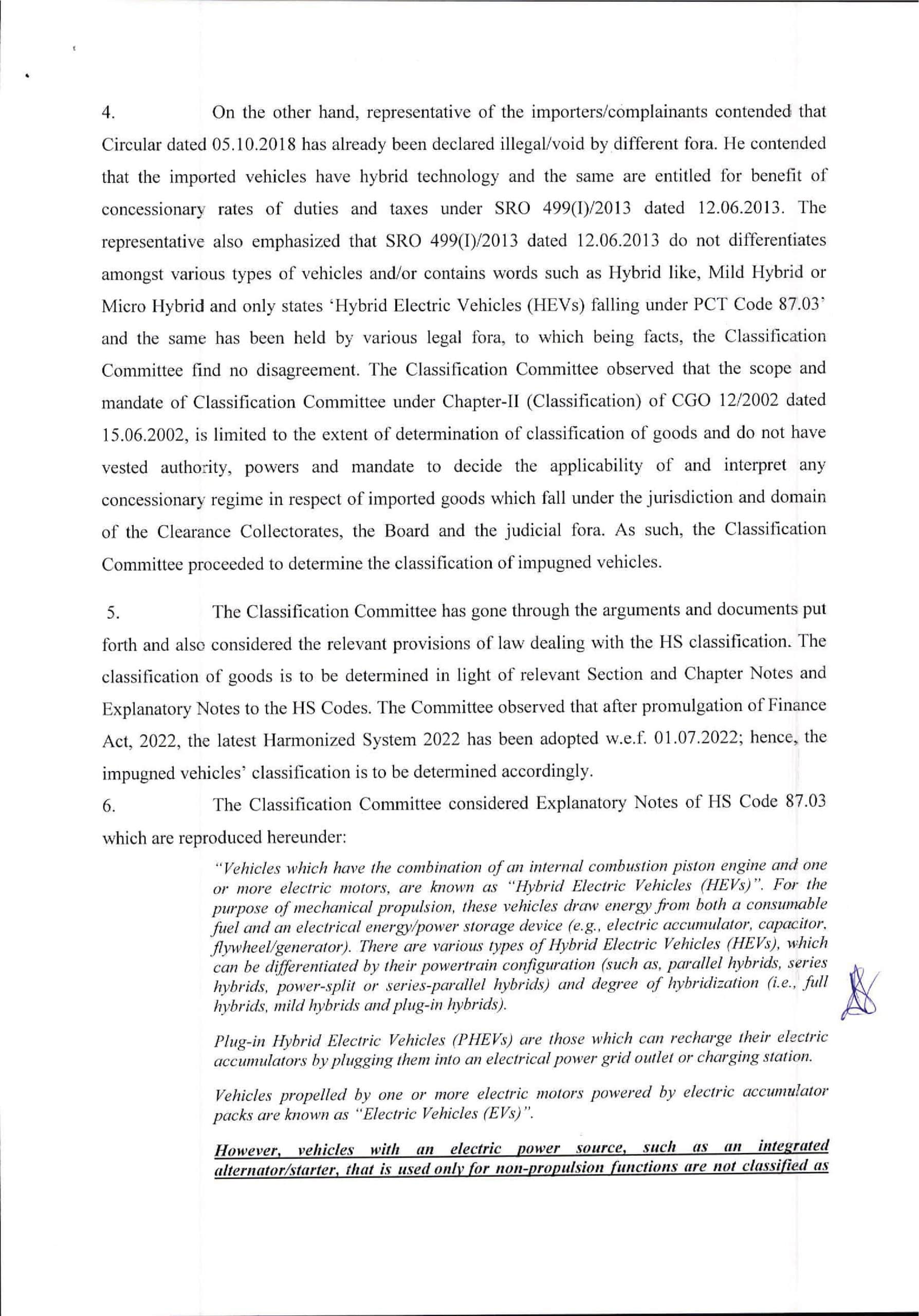

The Collectorate of Customs Appraisement, West, Karachi, delivered the Federal Tax Ombudsman’s (FTO) Findings/Recommendations/Order dated December 12, 2022. By which it instructed to report the complainant’s categorization of imported automobiles to the Classification Centre.

Used Semi-Hybrid Cars (Nisan Dayz, Suzuki Wagon-R, Suzuki Hustler)

Brief facts as reported are that complainant imported a ‘Used Hybrid Car (Nisan Dayz, Suzuki Wagon-R, and Suzuki Hustler) and claimed the benefit of cheaper rates of duties and taxes.

Under SRO 499(1)/2013 dated 12.06.2013 which was not allow in the light of Circular dated 05.10.2018 issued by the Collectorate of Customs, Appraisement-West, Karachi. Treating the vehicles as HEV-like Semi Hybrid Vehicles.

The importers/complainants filed subject complaints, which the FTO rejected with the above decision directing the issue to the Classification Centre.

On the other hand, representatives of the importers/complainants maintained that the Circular dated 05.10.2018. It previously ruled illegal/void by several discussion forums.

He claimed that imported automobiles using hybrid technology entitle to concessions duty and tax rates under SRO 499(1)/2013 dated June 12, 2013.

The representative also highlighted that SRO 499(1)/2013 dated 12.06.2013 does not differentiate between various types of vehicles and/or contains words. Such as Hybrid Mild Hybrid, or Semi Hybrid and only states ‘Hybrid Electric Vehicles (HEVs) falling under PCT Code 87.03’, which the Classification Committee finds to be facts.